News

Jacks of All Trades

Dealmaking in this environment is hard enough as it is. But imagine being a new, upcoming private equity firm trying to make a name for yourself? That’s even harder. We spoke to a few emerging managers to get their insights on what it takes to get a PE firm off the ground.

Mergers & Acquisitions

By Cheryl Meyer

20 March 2023

In 2016 Nathan Vanderploeg of Grand Rapids, Mich., took his most daunting professional leap: While working as a management consultant, he launched Monroe Equity Partners (MEP), a private equity firm that seeks out distressed or underperforming businesses that need saving. MEP focuses on corporate carve-outs and spin-offs, sometimes outright buyouts, and looks for deals that aren’t broadly marketed because they are “a little messy,” he says. This plan to seek out challenging deals stems partly from Vanderploeg’s background, but also from a need to differentiate MEP from other PE firms.

“It’s arguably one of the most competitive spaces in the world,” notes Vanderploeg, the firm’s managing director, about the private equity industry. “I really needed a differentiator.”

MEP now has five companies in its portfolio, including cannabis company C3 Industries (MEP was a founding investor and partner), and MessageWrap, an advertising platform for retail conveyor belts. He is also the CEO of MessageWrap, which MEP hopes to sell this year or next.

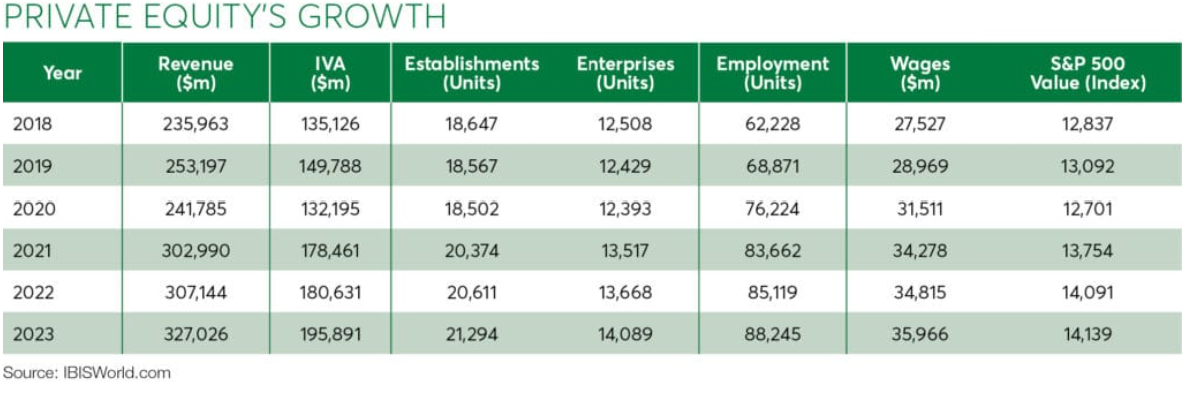

While Vanderploeg felt compelled to leave one paying job for a risky second act, he’s in no way alone. According to IBISWorld’s latest statistics, more than 14,000 U.S. private equity, hedge funds and investment vehicle businesses now exist, an increase of 2.4 percent from 2022. The playing field is crowded and competition for deals is fierce.

So what does it take to launch a private equity firm and then make it thrive in today’s investment market? Firm founders, who have learned lessons along the way, say leaders must take certain steps to set themselves up for success.

Ask Yourself: Are You Ready?

First and foremost, those wanting to enter this congested and chaotic turf must do an honest self-assessment, posing these key questions: Do I have the experience, money, business or industry knowledge — along with an established network of potential partners, shareholders and advisors — in order to launch a successful investment house? Do I think like an entrepreneur? Am I brazen and a risk taker?

Along with possessing self confidence, David Moross, co-founder, chairman and CEO of HighPost Capital LLC, in West Palm Beach, Fla., says he “needed to have deep and profound relationships with entrepreneurs, CEOs, bankers, counterparties, investors and many others” before starting his firm in 2019. Since its inception, HighPost has raised over $535 million in capital and invested in companies in the sports, media, lifestyle and wellness sectors. “You must have incredible range to be able to accomplish everything. This means being able to answer every question you are asked,” he adds.

You must also be willing “to roll up your sleeves and work hard alongside management teams,” and have a roster of devoted limited partners who share your vision, states Vlad Besprozvany, founder and managing director of Nexa Equity, a San Francisco-based PE firm pursuing software and fintech companies.

And you must have “deep experience and knowledge in the space where you operate,” since that helps you target companies in line with your investment strategy, he says. “We have an intentional focus on bootstrapped businesses, so understanding which companies have previously raised funding from VCs helps guide our sourcing efforts,” Besprozvany adds.

Firm leaders also should know what questions to ask in their respective sectors, in order to gain the confidence and trust of company owners. And they must have patience for the right deals and perseverance to weather business difficulties, states Christopher Bodnar, co-founder and CEO of Prescriptive Capital, a Denver-based PE firm launched in 2022. For instance, senior housing, one of the firm’s area of focus, is still recovering from the Covid crisis, he says.

“Every founder has dreams that revolve around building something great, making an impact while having fun and earning a lot of money,” he says. “However, no company progresses smoothly along this path as headwinds are an inevitable part of building businesses.” If those strong winds continue, a founder also needs vision to know when it’s time to pivot, he notes.

What’s more, PE firm founders must be able to think creatively, recognize industry trends and be able to identify holes in the market, says Buddy Gumina, founder and managing partner of New York-based Grant Avenue Capital, a healthcare-focused PE firm.

Leaders also need solid communication skills to govern and grow their portfolio companies effectively, Vanderploeg says.

And finally, founders need to put up their own money in deals. “Investors backing you want to know that you have skin in the game,” Moross notes.

Be Distinct and Different

In order to stand out from the private equity pack, firms must be focused — on a particular sector or product, on a geographic area, on the types of transactions they conduct or on their investment thesis, Vanderploeg summarized. “There are a lot of ways to get there, but you have to develop a differentiated story that resonates with people,” he says.

Besprozvany and his partners recognized “a gap in the market where capital was not being deployed,” and chose to focus on that area, he says.

Climate Adaptive Infrastructure (CAI), a San Francisco-based infrastructure investment firm focused on the energy, water and urban sectors, only funds companies that pass CAI’s strict low-carbon screening process. That mission has helped the firm attract solid investors. In October last year, CAI announced it had raised over $1 billion through the closing of its $825 million inaugural fund and its affiliated co-investment program of over $200 million.

“If you don’t have the ability to speak clearly on your strategy and what differentiates you, it’s virtually impossible to raise a first-time pool of capital,” states Bill Green, CAI’s founder and managing partner. “LPs are looking for differentiated thinking, and they want managers with the expertise, understanding and relationships that will ultimately drive value.”

Team Building and Culture

While personal skills and knowledge, along with a differentiated focus are key, a private equity firm can’t be successful without a “strong team committed to the mission of the organization,” Gumina says.

Gumina launched Grant Avenue Capital in 2019, and since then the firm has added professionals who are not only smart and skillful, but who enhance the firm’s culture. “I believe strongly that a diverse set of opinions will lead to better decision making and to do that, you have to make sure everyone has a voice in the discussion,” he says.

At CAI, Green also “sought out partners with diversity of thought and diversity of experience to make sure we did not see everything the same way,” he says. Because of this mixture of backgrounds and ideas, CAI’s “Investment Committee conversations are rich, challenging and thoughtful,” he notes. “Everyone contributes from their unique perspective, and this has proven to be one of the key strengths of our firm.”

Moross says he hand-selected his team at HighPost — people he has “known, respected, trusted and consider to be friends” over the course of his 30-year career. HighPost only hires people who share values across both personal and professional spectrums, he notes. Similarly, the executives at Nexa Equity also had worked together previously in their firm’s focused sectors, Besprozvany says.

To ensure a solid culture, leaders should take time to define their firms’ core values, and build their respective teams along those value streams, advises Vanderploeg. “And when you find someone that isn’t living out those core values, cut them loose early — because it’s too challenging of a space to operate with significant personnel friction,” he says.

Pros and Cons

Of course, there are pros and cons of launching one’s own firm.

The pros? Potential financial rewards, engaging work, an expanding network of limited partners and personal learning and growth opportunities.

“Far and away, the pro is being able to create value for our limited partners, portfolio companies and ourselves,” Moross says. “That is why we are in business.”

The cons? Administrative and human resources responsibilities, along with an exhaustive amount of work.

“On any given day, we are sourcing investments, completing diligence on prospects, strategizing with management teams, advising on portfolio company operations and keeping our investors updated on progress,” Besprozvany says.

“It’s a lot of hours,” notes Vanderploeg, who spends 80 percent of his time working on growth plans with his management team, and 20 percent sourcing deals. “And it’s also just constantly having to prioritize and reprioritize and say ‘no’ to so many things — and delegate because you’re very responsible to your investors and to the companies.”

The bottom line? New firm founders must be realistic as to what’s to come, should they take the PE plunge.

Running a private equity firm “is not as glamorous as a lot of people think it would be,” Vanderploeg adds. “It’s in the trenches, and you’ve got to be willing to do that work.”

Advice for Aspiring Private Equity Founders

Private equity leaders have learned many lessons along the way and offer the following advice to others who are considering launching their own firms:

- Seek help early on. “Find some operating partners who are later in their careers or are semi-retired and who have incredible experience and are willing to work with your firm part-time,” says Nathan Vanderploeg, founder of Monroe Equity Partners in Grand Rapids, Mich. “That’s been the number one thing we’ve done for our credibility and effectiveness.”

- Hire a strong team early in the process, since that can “set the tone for the culture and work ethic of the firm”, advises Vlad Besprozvany, founder and managing partner of Nexa Equity, a San Francisco-based PE firm. It’s vital to establish “a strong foundation at the outset, comprised of an entrepreneurial team, collaborative culture and differentiated strategy with a specialization component,” echoes Buddy Gumina, founder and managing partner of Grant Avenue Capital in New York. “Combine that with a heavy dose of pure grit, and it’s a winning combination.”

- “Have a clear, strategic vision about what you want to build,” Besprozvany says. “Ensure you have a deep understanding and experience in the sector you wish to focus.’”

- Put a lot of thought into your first investments, since they “form the backbone of your portfolio,” Besprozvany says. “Those companies become a reflection of your firm.”

- Don’t slack on governance, keep close tabs on your portfolio company operations — and don’t over-extend yourself or your team, Vanderploeg advises. “A lot of times it’s better to focus on one deal, one business at a time, and do well,” he says.

- Finally, “Learn to sleep,” adds David Moross, co-founder, chairman and CEO of HighPost Capital LLC in West Palm Beach, Fla. Despite the negatives of the business, particularly the hard work and long hours, PE firm founders say they wouldn’t hesitate to do it all over again, and launch a firm that can make a difference to not only themselves and their investors, but to the businesses they acquire.

“Launching Nexa has been one of the best decisions of my life, after marrying my wife and having our son,” Besprozvany says.